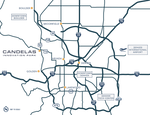

Perfectly poised near major universities, bustling cities, and well-connected airports, Candelas Innovation Park offers seamless connectivity in Jefferson County TO Boulder County.

DRIVE TIMES

UNIVERSITIES

REGIS UNIVERSITY

9.8 miles | 25 minutes

COLORADO SCHOOL OF MINES

10 miles | 15 minutes

UNIVERSITY OF CU BOULDER

12 miles | 25 minutes

UNIVERSITY OF DENVER

25 miles | 50 minutes

CITIES

GOLDEN

15 minutes

ARVADA

20 minutes

BOULDER

20 minutes

DENVER

30 minutes

AIRPORTS

ROCKY MOUNTAIN METROPOLITAN AIRPORT

15 minutes

DIA

40 minutes

DEMOGRAPHICS

5 MILES

POPULATION

39,462

EDUCATION (Bachelor's)

10,435

HOUSEHOLD INCOME

$196,585

INDUSTRY

(Construction, Manufacturing, Wholesale Trade, Transportation & Warehousing)

9,102

HOUSING UNITS

12,943

10 MILES

POPULATION

383,065

EDUCATION (Bachelor's)

88,318

HOUSEHOLD INCOME

$134,623

INDUSTRY

(Construction, Manufacturing, Wholesale Trade, Transportation & Warehousing)

43,854

HOUSING UNITS

124,816

15 MILES

POPULATION

1,119,147

EDUCATION (Bachelor's)

240,133

HOUSEHOLD INCOME

$127,305

INDUSTRY

(Construction, Manufacturing, Wholesale Trade, Transportation & Warehousing)

135,228

HOUSING UNITS

361,430

JEFFCO ECONOMIC INCENTIVES

The Enterprise Zone (EZ) program is designed to promote job creation, business growth, and development opportunities in areas of the Jefferson County targeted for economic stimulation. Businesses locating within the Jefferson County EZ may be eligible for one or several of the below state income tax credits related for qualifying investments made. Prior to each income tax year, a business located in an EZ must apply and be pre-certified prior to beginning an activity to earn any of the business tax credits. At the end of the income tax year, a business must certify that the activities were performed.

Jeffco EDC serves as the Enterprise Zone Administrator for Jefferson County, managing and marketing the program on behalf of the Colorado Office of Economic Development and International Trade. (OEDIT).

TAX CREDIT

AMOUNT

3% of capital investment purchases

$1,100/net new employee

$1,000/employee first 2 years in EZ

12% of qualified training expenses

3% of increased R&D expenditures

25% of rehab expenditures

Expanded S&U tax exemption under EZ